Trump, Vance, and the Dollar

As you may know, I've written and posted a few things in the past about the $'s position in the international monetary and financial system (IMFS) and about the idea that $ centrality in the IMF is an Exorbitant Burden (I disagreed).

But in the wake of Trump’s VP pick of J.D. Vance (who made exactly this point with a question to Fed Chair Powell), there has been a lot of attention to the idea that a Trump/Vance ticket is a weak $ ticket. And Trump’s own pronouncements on the subject bear that out. See this for example.

Conversely, there has been pushback to the argument that the $ could weaken under Trump because there is no alternative to the $ (a condition I like to call TINAcity). But I would note that it is important to distinguish centrality in the IMFS from strength--the $ has been central for 50+ years, but has gone up and down in many cycles over that period, so it is important not to conflate the two. In addition, I believe very strongly that the most important aspect of $ centrality in the IMFS is less its role as a reserve asset and more its role as the dominant denomination of cross-border liabilities. And (this is really important), the $’s rule as the preferred denomination of cross-border liabilities typically expands when the $ is going through one of its cycles of weakness.

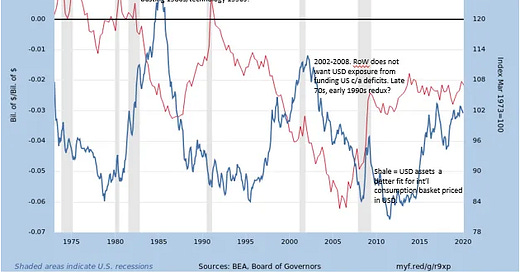

I’ve written at some length here about how what really drives the $ up or down is the interaction of the size and composition of the US’s external financing deficit with the perceived rate of return on US assets, US terms of trade etc. And here’s a chart from that piece that lays out the point.

Anyway, here's a quick list of things that might (but need not necessarily) lead to market-led $ weakness concomitant with the wishes of such an (as of now still hypothetical) administration.

Appointment of a very dovish Fed Chair, or board appointments to empty seats that signal the same. A point I made 8 years ago is that one is unlikely to get a classic Reagan-Volcker policy mix when the balance of national power rests with a swing-voter who likes Dick Gephardt. And I had tried to have fun with the name of such a dove here, but the point stands.

Low multiplier fiscal stimulus.

1 and 2 together present an interesting puzzle. Many FX people believe that what drives exchange rates is front-end policy rates rather than the back end of the yield curve. And a central bank that has lower interest rates than the market considers cyclically warranted could lead to higher long-term interest rates, but it’s not clear that would be quite as favorable for a currency. And the combination would allow a steeper yield curve via both short and long rates, allowing those who want exposure to higher yields to hedge their FX risk. So (and at the considerable risk of disagreeing with Brad Setser—who is mostly always right) I’m unconvinced that expansionary fiscal policy and higher long yields would in themselves lead to $ strength in the absence of Fed actions that deliver higher short rates than would otherwise have been the case.

There is a frequent argument that high tariffs would result in a lower external financing requirement that should strengthen the $, but conversely one could see tariffs result in low productivity Import-Substitution Industries with lower IRRs that recede from the global technological frontier (says Area Man who grew up with Ambassador cars in 1970s India). Attitudes toward climate change/EVs may result in such an outcome. Meanwhile, in the event of a large technological shift, there might be less support to the US Terms of Trade (relative to other countries) from its relatively newfound position as a big oil producer.

Over the nearer term, there may be opportunities to engage in joint intervention with other areas (JP certainly) upset about FX weakness. This is a course of action I have endorsed (to little effect) here. Further, while I am skeptical that higher tariffs would result in $ strength, it also presents some interesting game theoretic questions. If in fact, there is a general belief that tariffs do lead to $ strength, then this means that the currency impact obviates part of the desired effect of the tariffs —making imports into the US more expensive. In such a world, there would be a case (perhaps appreciated by someone who famously thinks of deals as an art) to make a deal to weaken the $ AS A SUBSTITUTE FOR TARIFFS, which would almost certainly make everyone happier. The piece I linked to in this paragraph makes precisely such an argument for collaborative currency policy being a substitute for conflictual trade policy.

The administration could take (or even just hint at) geopolitical measures that lead to increased fiscal stimulus overseas that change the fiscal monetary-mix there. Increased pan-EU defense spending (perhaps even financed by joint and several issuance that increases the supply of Euro-denominated safe-assets) might be one outcome of geopolitical uncertainty. Thanks to Red for bringing this up.

This last is the most unlikely IMO, but the range of inbound capital controls that already exist in the FDI and Equity space (CFIUS etc.) could be extended to fixed-income, as implied here by Michael Pettis. “If the United States wants to eliminate its trade deficits, it must change tactics. Rather than restrict trade, the policymakers must restrict the ability of countries that run persistent trade surpluses to dump their excess savings into U.S. financial markets. They should unilaterally restrict harmful capital inflows in ways that leave productive, long-term investment in the American economy unaffected.”

Anyway, this is a quick list of "things that might but need not necessarily happen." For those looking for precedents, I would note that much of the period between 1986 and early 1995, i.e., between the Plaza Accord and the ascension of Robert Rubin to Treasury Secretary was marked by concerns about US dual deficits leading to $ weakness despite Fed hikes or higher UST yields. See, for example, this from Steve Solomon’s The Confidence Game, the book I have bought and given away to colleagues more times than any other. Just saying…..

RANDOM ENTHUSIASM/DAD JOKE

I have just discovered that the channel MHz (round the clock European detective stories available on broadcast, Samsung+, and streaming) carries a three season miniseries 1992, 1993, and 1994 called (in English) Berlusconi Rising, which chronicles Italian politics in that tumultuous period. It’s kinda trashy but also captures the high politics and the atmosphere pretty well I think (but I’m not really an expert). Still, I was there doing dissertation research on 19th century Southern Italian lawyers around that time so I remember the mood music certainly, especially the bleak summer of 1992 around the Borsellino and Falcone assassinations. Following on that, just to catch up, I reread three great pieces I remembered from Jane Kramer in the New Yorker, which I also recommend, even though it’s pretty clear that that the magazine’s archives before 2008 consist of an intern with a photocopier. (My copy of Alexander Stille’s Sack of Rome, also fantastic, is in storage right now). And since I owe you a joke, here’s a topical (niche) one from the archives about the two principals of this stack—A difference between Trump and Berlusconi is that while one tried a Colpo di Stato to hold power, the other was satisfied with owing his position to Colpo Grosso.